Sprague Regulatory Matters is provided as a courtesy to our customers. Please note that the information contained in Sprague Regulatory Matters is for informational purposes only and should not be construed as legal or business advice on any subject matter. You should not act or refrain from acting on the basis of any information included in this without seeking legal or professional advice.

Natural Gas Consumption Sets New Record

National – Natural Gas

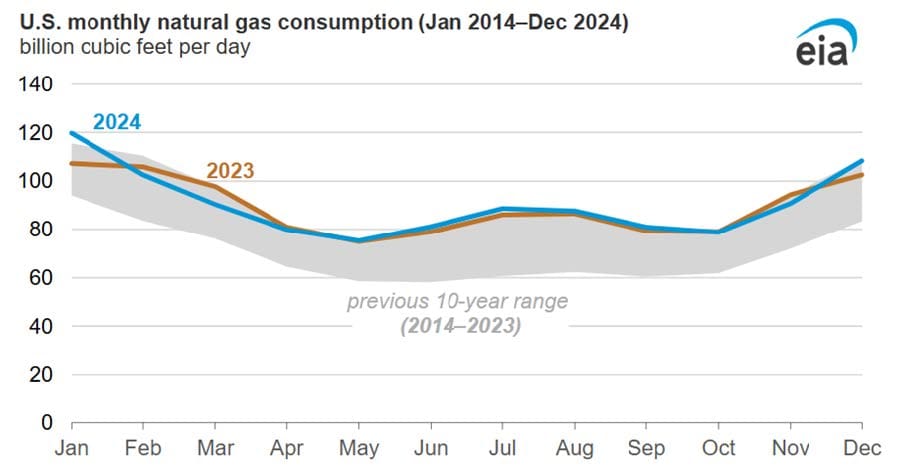

U.S. natural gas consumption set new winter and summer monthly records in 2024 (U.S. natural gas consumption set new winter and summer monthly records in 2024 ‐ U.S. Energy Information Administration (EIA)). Natural gas consumption averaged a record 90.3 billion cubic feet per day

(Bcf/d) and set new winter and summer records. In January 2024, natural gas consumption was up 12

percent (12.5 Bcf/d) compared with January 2023 consumption, and in July, consumption increased by

3 percent (2.5 Bcf/d) compared with July 2023.

Federal Energy Regulatory Commission Leadership

National – Electric & Natural Gas

President Trump nominated Laura Swett to serve as Federal Energy Regulatory Commission (FERC) Commissioner. Swett is counsel at Vinson & Elkins, where she specializes in federal and state energy and regulatory litigation and she regularly represents pipeline and electric power companies before the FERC. Prior to joining Vison & Elkins, Swett was a legal adviser at FERC to former Commissioner Bernard McNamee and former Chairman Kevin McIntyre. Prior to that, she worked as an investigatory attorney in the commission’s Office of Enforcement. Swett holds a Bachelor of Arts degree in American Government from the University of Virginia and a Juris Doctor degree from Georgetown University.

Power Trends 2025: Annual State of the Grid and Markets Report

New York – Electric

The New York Independent System Operator (NY‐ISO) issued its annual Power Trends report 2025 Power Trends Report) that provides an in‐depth look at the forces shaping the future of the New York State electric grid. The 2025 report focuses on issues and challenges shaping the grid of the future. Key points in Power Trends 2025 include the following: (1) Generator deactivations are outpacing new supply additions. (2) As public policy goals seek to decarbonize the grid, fossil‐fired generation will be needed for reliable power system operations until the capabilities it offers can be supplied by other resources. (3) Repowering aging power plants can lower emissions, meet rising consumer demand, and provide reliability benefits to the grid that are needed to integrate additional clean energy resources. (4) New York is projected to become a winter‐peaking electric system by the 2040s, driven primarily by electrification of space heating and transportation. On the coldest days, the availability of natural gas for power generation can be limited, and interruptions to natural gas supply will introduce further challenges for reliable electric grid operations. (5) Driven by public policies, new supply, load, and transmission projects are seeking to interconnect to the grid at record levels. (6) The competitive wholesale electricity markets administered by the NY‐ISO support reliability while minimizing costs to consumers.

The Future of Natural Gas

Maine – Natural Gas

The Maine Public Utilities Commission commenced a proceeding, An Inquiry Regarding the Future of Natural Gas, Docket No. 2025‐00145 (Case Details) noting that 12 states and the District of Columbia have launched similar proceedings and that aligning gas utility regulation with state greenhouse gas emission (GHG) goals is a key motivator in other jurisdictions. The commission is opening this inquiry with the following goals: (1) to develop a consistent methodology or framework to incorporate and evaluate the GHG emissions impact in the commission’s decision making regarding gas infrastructure investments and contractual commitments for supply or capacity needed to serve customers; (2) to evaluate the consistency of these investments with state goals; and (3) to assist in evaluating a broader path for the future of natural gas in Maine. The commission is seeking comments on a number of policy matters.

ISO New England CEO to Retire – Successor Named

New England – Electric

ISO New England (ISO‐NE) announced that President and CEO Gordon van Welie will retire January 1, 2026 (20250623_pr_ceo_retirement.pdf). ISO‐NE’s Board of Directors has selected Dr. Vamsi Chadalavada, currently ISO‐NE’s chief operating officer (COO), as van Welie’s successor. Joining ISO‐NE in 2000, van Welie served as chief operating officer before being promoted to CEO in 2001. In his tenure, van Welie led strategic initiatives to keep grid system reliability intact and the wholesale electricity markets competitive during significant shifts in the region’s policies, generation sources, and technologies.

Federal Energy Regulatory Commission – Summer 2025 Assessment

National – Electric

The Federal Energy Regulatory Commission (FERC) released Staff’s Summer 2025 Assessment (FERC Releases 2025 Summer Assessment | Federal Energy Regulatory Commission) on the outlook for energy markets and electric reliability during the June to September timeframe. The assessment details that if normal operating conditions prevail, all regions of the country will have adequate generating resources to meet expected summer demand and operating reserve requirements; however, margins are getting tighter as generation resources retire and load increases largely due to hyperscale users, such as data centers. Regions such as Northeast Power Coordinating Council (NPCC) – the New England region, Midcontinent Independent System Operator (MISO), the Electric Reliability Council of Texas (ERCOT), Southwest Power Pool (SPP) and PJM Interconnection may face a higher likelihood of tight generation availability due to above‐normal electricity demand, periods of low wind and solar output, wildfires that disrupt available transfers and generator availability, and retirements of generation capacity. If warmer‐than‐average temperatures occur, the electric grid will likely be challenged throughout the continental United States with increased uncertainty due to weather events, weather forecasting, and energy demand. In addition, load is expected to be higher this summer compared to the past four summers. Wholesale electricity prices are expected to be higher this summer as compared to last summer in most regions, especially in Northeast U.S. The increase in prices is partially due to higher natural gas prices at all major trading hubs across the country because of lower natural gas storage levels due to a colder winter than previous years.

Competitive Energy Groups Urge DOJ to Eliminate Anticompetitive Regulations

National – Electric & Natural Gas

The Retail Energy Advancement League, the Electric Power Supply Association, the Retail Energy Supply Association, and the Energy Professionals Association collectively filed comments (Competitive Energy Groups Urge DOJ to Eliminate Anticompetitive Energy Regulations ‐ EPSA) with the U.S. Department of Justice (DOJ) Anticompetitive Regulations Task Force requesting that the DOJ recommend the adoption of federal legislation which would impose specific limitations on the traditional authority of state and local governments in order to achieve retail energy choice. The comments include the following major points: First, the Competitive Energy Associations have identified opportunities for action and advocacy regarding federal laws and regulations that create unnecessary barriers to competition. Similar to the communications competition revolution of the mid‐ 1990s, the energy industry is ripe for reform at the legislative, administrative review, and regulatory levels, including the elimination of specific burdensome federal regulations. Second, the Competitive Energy Associations have identified several areas of state legislation on which the Task Force could provide comments in support of competition and open access interstate commerce in light of dormant Commerce Clause principles. The Competitive Energy Associations also have identified state regulatory proceedings in which the Task Force may wish to represent the federal government’s interests as well as several private litigations in which the Task Force may file amicus briefs or statements of interests that promote competition and oppose.

Disclaimer of Liability

Every effort is made to provide accurate and complete information in Sprague’s Regulatory Matters. However, Sprague cannot guarantee that there will be no errors. Sprague makes no claims, promises, or guarantees about the accuracy, completeness, or adequacy of the contents and expressly disclaims liability for errors and omissions in the contents of this update.

Neither Sprague nor its employees make any warranty, expressed or implied or statutory, including but not limited to the warranties of noninfringement of third‐party rights, title, and the warranties of merchantability and fitness for a particular purpose with respect to content available from Regulatory Matters. Neither does Sprague assume any legal liability for any direct, indirect or any other loss or damage of any kind for the accuracy, completeness, or usefulness of any information, product, or process disclosed herein, and does not represent that use of such information, product, or process would not infringe on privately owned rights.

The materials presented in Regulatory Matters may not reflect the most current regulatory or legal developments, verdicts, or settlements, etc. The content may be changed, improved, or revised without notice.

Copyright Statement

All content within Sprague Regulatory Matters is the property of Sprague unless otherwise stated. All rights reserved. No part of Regulatory Matters may be reproduced, transmitted, or copied in any form or by any means without the prior written consent of Sprague.