Sprague Regulatory Matters is provided as a courtesy to our customers. Please note that the information contained in Sprague Regulatory Matters is for informational purposes only and should not be construed as legal or business advice on any subject matter. You should not act or refrain from acting on the basis of any information included in this without seeking legal or professional advice.

Natural Gas and Electricity Consumption Forecasted to Grow

National – Electric & Natural Gas

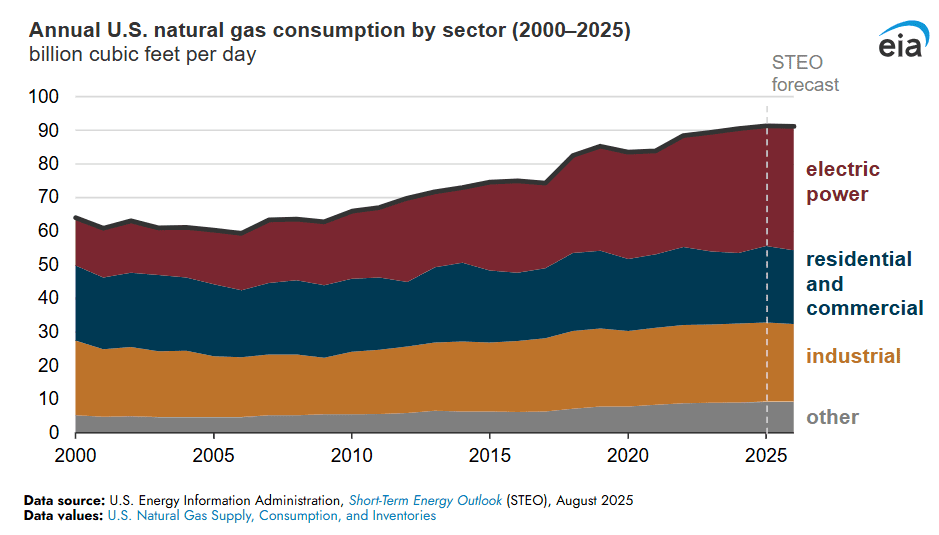

U.S. natural gas consumption in the United States is forecasted to increase 1 percent to set a new record of 91.4 billion cubic feet per day (Bcf/d) in calendar year 2025 (EIA expects record U.S. natural gas consumption in 2025 – U.S. Energy Information Administration (EIA)).

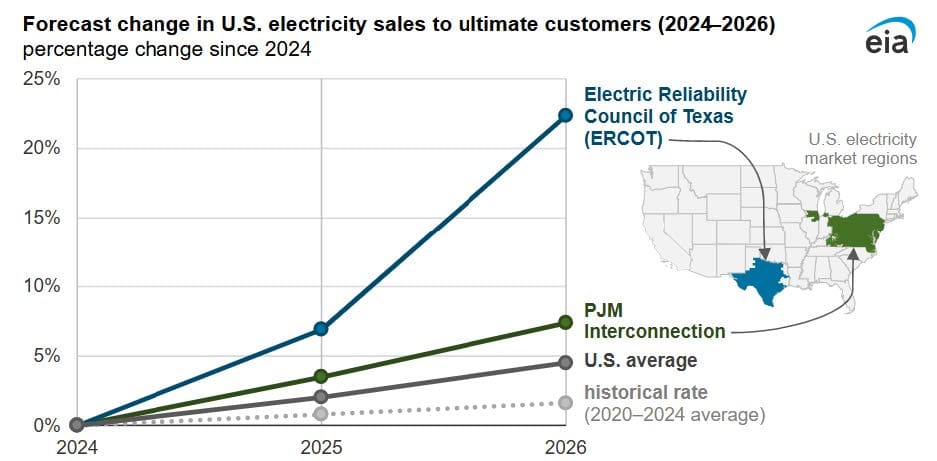

U.S. retail electricity sales to ultimate customers is projected to grow at an annual rate of 2.2 percent in both 2025 and 2026, compared with average growth rate of 0.8 percent between 2020 and 2024 (We expect rapid electricity demand growth in Texas and the mid-Atlantic – U.S. Energy Information Administration (EIA)). The forecast reflects rapid electricity demand growth in Texas and several mid-Atlantic states, where the grid is managed by the Electric Reliability Council of Texas (ERCOT) and the PJM Interconnection, respectively. The U.S. Energy Information Administration (EIA) expects electricity demand in ERCOT to grow at an average rate of 11 percent in 2025 and 2026 while the PJM region grows by 4 percent.

Federal Energy Regulatory Commission – Policy Statement on Certification of New Interstate Natural Gas Pipeline Facilities

National – Natural Gas

In February 2022, the Federal Energy Regulatory Commission (FERC) issued an updated policy statement intended to explain how the Commission’s approach to considering applications to construct new interstate natural gas transportation facilities under the Natural Gas Act would differ going forward from the approach described in the policy statement on the topic issued in 1999. U.S. Energy Secretary Chris Wright asked the FERC to rescind a proposal to revise the Commission’s natural gas pipeline certificate policy noting that withdrawing the draft plan floated in 2022 would provide certainty to the natural gas sector. On September 12, 2025, the FERC issued an order terminating this proceeding. The FERC stated in its order; “We believe that the 1999 Certificate Policy Statement, as subsequently applied by the Commission, continues to provide the appropriate framework for reviewing proposed natural gas projects in a legally durable manner, pursuant to the Natural Gas Act and consistent with judicial precedent, as it has for over 25 years.”

Renewable Energy Fund Surplus Transfer

New Hampshire – Electric

The New Hampshire state budget, signed by Governor Ayotte will transfer most of the money from the state’s Renewable Energy Fund to the general fund over the next two years, cutting investment in clean energy projects by roughly 50 percent from recent spending levels. The budget redirects approximately $15 million in surplus funds and all incoming revenue – between $3 to $7 million annually – to the general fund through June 2027. One million dollars per year will remain available for renewable energy projects. The Renewable Energy Fund accumulated a large surplus because the Department of Energy was spending only about $2 million annually despite more revenue flowing into the account each year through alternative compliance payments that electric utilities make to the fund when they cannot meet renewable energy requirements. The surplus grew to approximately $20 million, with about $15 million unawarded, before lawmakers approved the move to transfer the funds.

Changes in Electric Standard Offer Service Supply

Connecticut & District of Columbia – Electric

With a trend that is growing in other jurisdictions, the Connecticut Legislature enacted Public Act 25-173 that requires that an electric utility distribution company’s (EDC) standard offer service procurement plan include a requirement that the EDC be able to engage in dynamic market purchases for not less than 25 percent of the standard offer service load. Dynamic market purchases refer to the purchase of energy, capacity or other market products necessary to serve standard offer service electric load using market purchases in the regional independent system operator markets, financial contracts, or other variable procurement techniques. The prior statute provided that standard offer service procurement, in addition to load following contracts, may include contracts for generation or other electricity market products and financial contracts. While this provision remains, the new law also requires an EDC to be able to engage in dynamic market purchases. The District of Columbia Public Service Commission issued an order removing a 5 percent standard offer service load cap and directing Potomac Electric Power Company to try to procure up to 25 percent of the standard offer service load requirements through renewable energy purchase power agreements.

Exploring Withdrawal from ISO-New England

New Hampshire – Electric

New Hampshire Governor Kelly Ayotte signed into law House Bill 690 (NH HB690 | 2025 | Regular Session | LegiScan) directing the state’s Department of Energy to study the potential impacts if the state of New Hampshire were to withdraw from ISO New England. The legislation directs the State to examine the role of the grid operator and identify any ISO New England functions that the State could do itself. As New Hampshire power rates have increased over 50 percent between 2018 and 2023, HB 690 also directs the state Department of Energy to investigate other strategies to assure that New Hampshire ratepayers do not pay for the public policy initiatives of other New England states, including environmental policies, in a manner that is unjust and unreasonable.

PJM Interconnection Cost Increases

PJM Region – Electric

Governors in the PJM (Pennsylvania – New Jersey -Maryland) Interconnection continue to raise concern over electricity cost increases within the region. A joint letter was sent by nine Governors (20250717-nine-governors-letter-regarding-board-vacancies.pdf) and Ohio Governor DeWine sent a separate letter. The Governors criticize the lack of control over rising electricity costs within PJM serving as the grid operator for all or part of New Jersey, Pennsylvania, Delaware, Maryland, Virginia, West Virginia, North Carolina, Tennessee, Kentucky, Ohio, Indiana, Illinois, Michigan and the District of Columbia.

Potential Supply of Natural Gas in the United States

National – Natural Gas

The Potential Gas Committee, a group of industry personnel organized by the Colorado School of Mines, provides a biannual assessment of the U.S. gas supplies that are proven, probable and speculative (Potential Gas Agency | Colorado School of Mines). A growing resource base in the Haynesville Shale region of the U.S. Gulf Coast and a revised assessment of Alaska’s resources contributed to a 16 percent growth in technically recoverable gas, the Potential Gas Committee stated. The latest report states that the U.S. had 3,871 trillion cubic feet (Tcf) of recoverable natural gas at the end of 2024, a record level and 507 Tcf higher than the 2023 report. The technically recoverable resources, when combined with proven gas reserves listed by the U.S. Energy Information Administration, put the total U.S. gas supply base at 4,562 Tcf.

Disclaimer of Liability

Every effort is made to provide accurate and complete information in Sprague’s Regulatory Matters. However, Sprague cannot guarantee that there will be no errors. Sprague makes no claims, promises, or guarantees about the accuracy, completeness, or adequacy of the contents and expressly disclaims liability for errors and omissions in the contents of this update.

Neither Sprague nor its employees make any warranty, expressed or implied or statutory, including but not limited to the warranties of noninfringement of third-party rights, title, and the warranties of merchantability and fitness for a particular purpose with respect to content available from Regulatory Matters. Neither does Sprague assume any legal liability for any direct, indirect or any other loss or damage of any kind for the accuracy, completeness, or usefulness of any information, product, or process disclosed herein, and does not represent that use of such information, product, or process would not infringe on privately owned rights.

The materials presented in Regulatory Matters may not reflect the most current regulatory or legal developments, verdicts, or settlements, etc. The content may be changed, improved, or revised without notice.

Copyright Statement

All content within Sprague Regulatory Matters is the property of Sprague unless otherwise stated. All rights reserved. No part of Regulatory Matters may be reproduced, transmitted, or copied in any form or by any means without the prior written consent of Sprague.